Wednesday, March 6, 2024 @ 5PM PST

Join us via YouTube or Facebook while we stream live!

Do you want to buy a home but need help getting started? We have been delivering successful homebuyer workshops since 2015. Our goal with this workshop is to educate you about the process of purchasing a home. The more prepared and educated you are, the less stressful the experience will be. This should be an exciting time, not an emotional and upsetting transaction.

We will be covering the following:

-

- Real Estate and Mortgage Buzz Words – the most utilized words and their definitions within a real estate transaction

- Loan Programs and their guidelines – FHA/USDA/VA/CONVENTIONAL

- Closing Costs

- Credit Repair

- Escrow

- Getting Pre-Approved

- Locking in your interest rate

- Signing your disclosures

- Ordering your appraisal

- Conditional Loan Approval

- Final Loan Approval

- Signing Loan Documents

- Funding and Closing

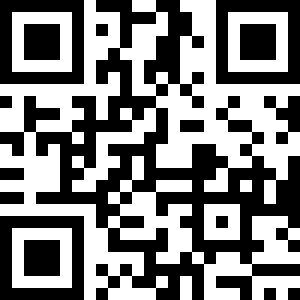

We can’t wait to see you there! RSVP using the QR Code below. You will receive a link by text to join us via YouTube, 5 minutes prior to the start time. You will be able to get interactive with us and ask your questions through live chat during the workshop.